-

-

News

-

Will SVB and Signature Bank Collapse Trigger Domino effect?

MTrading Team • 2023-03-16

Will SVB and Signature Bank Collapse Trigger Domino effect?

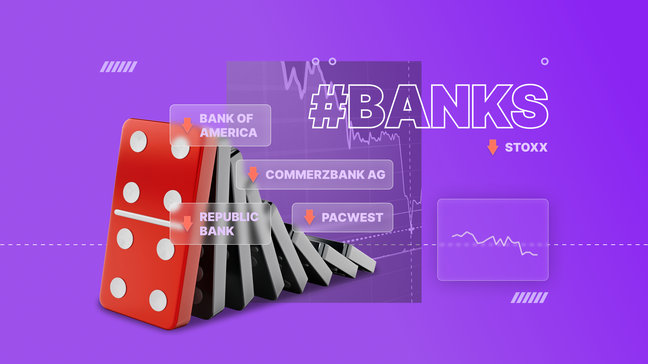

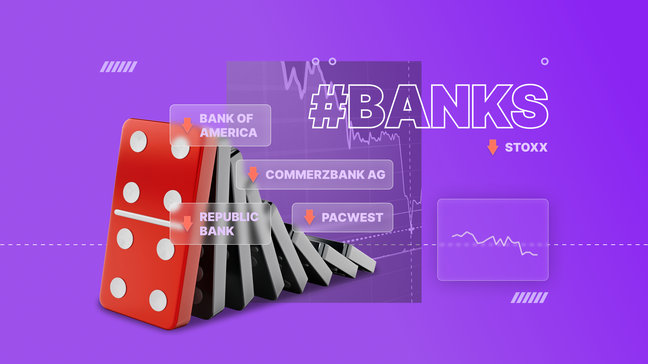

The Silicon Valley Bank and Signature Bank shutdown can trigger the domino effect in the US banking field. Major market shares are currently dropping and trading down alongside crude oil. The downfall is taking place despite the measures taken by the FED. Nevertheless, US authorities guarantee deposit protection for SVB clients.

Banking Index Down

STOXX banking index lost 5.8% to shed 3.78% during Friday’s trading session to come up with a total loss of 9.58% within only two days. We are actually seeing the biggest decline happen since the Ukraine conflict breakout back on March 22.

Other major financial institutions, such as Credit Suisse Group AG, are experiencing largest all-time drops. Additionally, Commerzbank AG reported having over 12% losses. US-based banks also follow the negative fallout featuring Bank of America losing 3.7% during the pre-market trading session.

Industry-best trading conditions

Deposit bonus

up to 200%

Spreads

from 0 pips

Awarded Copy

Trading platform

Join instantly

Smaller lenders and financial institutions are put under the biggest pressure. First Republic Bank and PacWest experienced a decline of around 60% and 40% respectively.

Bank Collapse Triggers

Silicon Valley Bank was the first to launch the domino effect on US banking after its sensational shutdown. It appeared to be the biggest banking failure since 2008 when clients had to draw out their dividends.

Followed by the SVB shutdown, the Signature Bank collapse triggered an even higher level of uncertainty. Bank regulators had nothing to do but appoint the Federal Deposit Insurance Corporation to protect deposits and become the bank’s asset receiver.

All these events stressed the US economy which has always been a signature of the safe and reliable banking system. The government took specific steps to provide SVB clients access to their funds.

May the trading luck be with you!