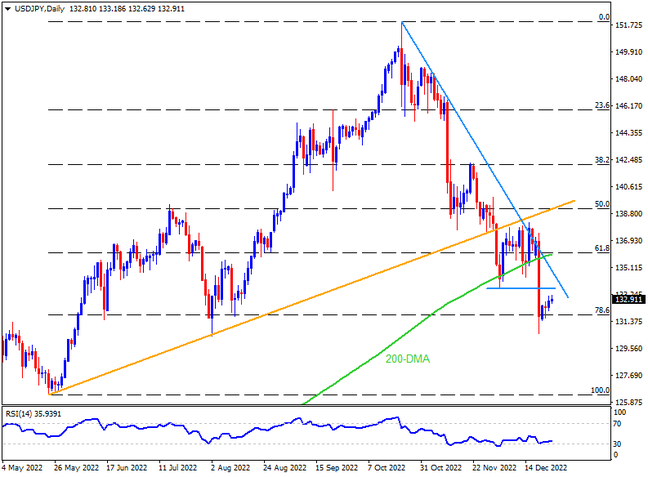

USDJPY consolidates the biggest daily loss in 14 years while positing a gradual rebound from the 78.6% Fibonacci retracement level of its May-October upside. The recovery moves also gain support from the RSI’s bounce off the oversold territory. However, the early month low near 133.65 challenges the immediate upside, a break of which could validation the Yen pair’s further advances towards a convergence of the 200-DMA and a two-month-old descending resistance line, close to 136.00. In a case where the quote remains firmer past 136.00, the previous support line from, close to 138.80-85, will be crucial as a break of which could welcome bulls.

Alternatively, a daily closing below the 78.6% Fibonacci retracement near 131.80 precedes the August 2022 low near 130.40 to challenge the USDJPY bears. Also acting as a downside filter is the 130.00 round figure. Should the pair sellers keep the reins past 130.00, multiple hurdles near 128.30 could offer intermediate halts during the quote’s anticipated south run towards May’s low of 126.35.

Overall, USDJPY bears are taking a breather and still hold control despite the latest corrective bounce.

Join us on FB and Twitter to stay updated on the latest market events.