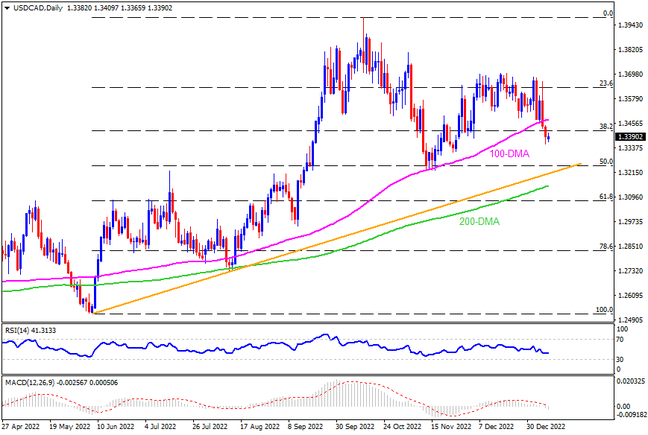

USDCAD remains depressed at the lowest levels in six weeks after breaking the 100-DMA as broad US Dollar weakness joins firmer oil prices. Even so, the bears are waiting for the Bank of Canada (BOC) Governor Tiff Macklem’s speech for further directions. That said, the 50% Fibonacci retracement level of June-October upside, near 1.3250, appears the immediate support ahead of an upward-sloping support line from June 2022, close to the 1.3200 round figure. Should the Loonie pair drops below 1.3200, the 200-DMA support level of 1.3150 could act as the last defense of the pair buyers.

On the contrary, the 100-DMA hurdle surrounding 1.3480 challenges the short-term recovery moves of the USDCAD pair. Following that, a run-up towards the previous monthly peak of around 1.3700 can’t be ruled out. It’s worth noting, however, that multiple resistances around 1.3800 and 1.3850 could challenge the pair buyers past 1.3700, a break of which could propel prices towards the year 2022 top of 1.3977.

Overall, USDCAD is well-set on the bear’s radar after breaking the 100-DMA.

Join us on FB and Twitter to stay updated on the latest market events.