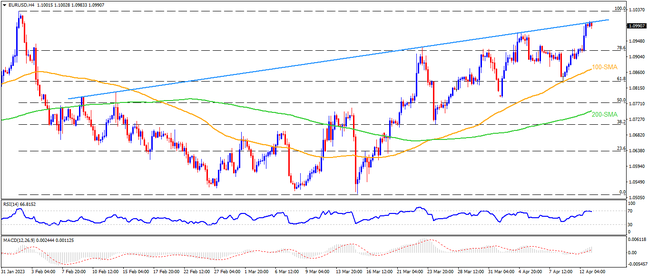

EURUSD bulls struggle at an 11-week-high as an upward-sloping trend line resistance challenges the major currency pair’s further upside around the 1.1000 psychological magnet. Adding strength to the stated resistance is the overbought RSI conditions. Even if the quote manages to cross the 1.1000 hurdle, the YTD high marked in February around 1.1035 could act as an additional upside filter for the bulls to tackle before approaching the late March 2022 peak around 1.1185. Following that, the previous yearly high of 1.1495 will be in focus.

Alternatively, the EURUSD pullback could initially aim for the 1.0930 resistance-turned-support area comprising multiple levels marked in the last two months, a break of which will highlight the 100-SMA level of 1.0860 as the key support. It’s worth noting, however, that a clear downside break of 1.0860 won’t hesitate to drag the Euro pair toward the monthly low of near 1.0785. Though, the 200-SMA level of 1.0745 could restrict the quote’s south run afterward.

To sum up, EURUSD bulls appear running out of steam and hence a pullback in prices can be expected. However, the bearish trend is still far from sight.

Join us on FB and Telegram to stay updated on the latest market events.