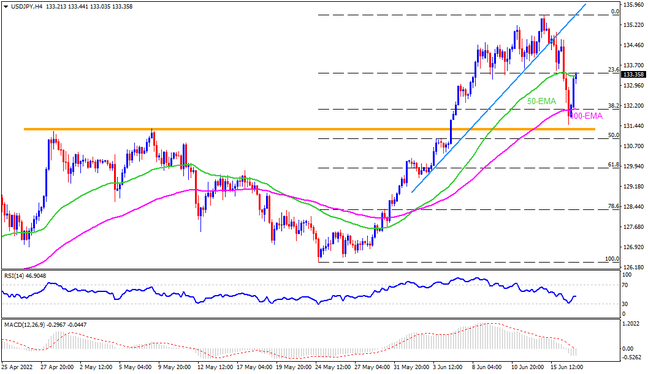

A clear downside break of the fortnight-old support line, favored USDJPY bears in the last few days. However, a convergence of the 100-EMA and 38.2% Fibonacci retracement of May 24 to June 14 upside, around 132.00, seemed to have triggered the latest rebound. Also acting as short-term key support is a horizontal area comprising tops marked during late April and early May, surrounding 131.25-35. As the RSI (14) bounces off oversold territory, the aforementioned supports could form the pair’s bottom as traders await Bank of Japan (BOJ) monetary policy meeting results and a speech from Fed Chairman Jerome Powell. Should the quote drop below 131.25, the 61.8% Fibo. level near 129.80 might return to the charts.

Meanwhile, a confluence of the 50-EMA and 23.6% Fibonacci retracement level, close to 133.40, guards the immediate upside. Following that, the support-turned-resistance from early June and the latest peak could challenge the USDJPY buyers around 135.60. If at all the quote rises past 135.60, the late 1998swing highs near 137.30 and 138.30 could probe the bulls before directing them to the 140.00 psychological magnet.

On the fundamental side, the BOJ isn’t expected to announce any major changes to its monetary policies, which in turn makes the event less important than Powell’s speech. Though, the current environment of central banks providing hawkish surprises might push the traditional dove, which in turn can entertain USDJPY traders.

Join us on FB and Twitter to stay updated on the latest market events.