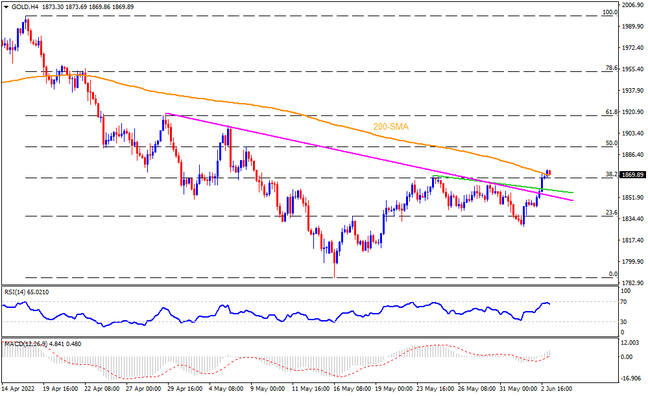

Gold prices seesaw around the monthly top after crossing a five-week-old resistance line, as well as a weekly hurdle. The recently bullish MACD signals and firmer RSI also favor the buyers as they attack the 200-SMA level surrounding $1,872, the last defense for bears. Should the US Nonfarm Payrolls (NFP) manage to propel the quote beyond $1,872, an upward trajectory towards the $1,900 threshold can’t be ruled out. Following that, the late April swing high and 61.8% Fibonacci retracement of the April-May downturn, near $1,920, should gain the market’s attention.

On the contrary, strong NFP prints could weigh on the gold prices and drag it back below the resistance-turned-support around $1,853. In that case, the 23.6% Fibonacci retracement level and the latest swing low, respectively near $1,835 and $1,828, could lure the gold bears. It’s worth noting that the precious metal’s downside past $1,828 won’t hesitate to break the $1,800 threshold before targeting May’s bottom of $1,786.

Overall, gold prices are likely to rise further as global markets await the US employment data for May.

Join us on FB and Twitter to stay updated on the latest market events.