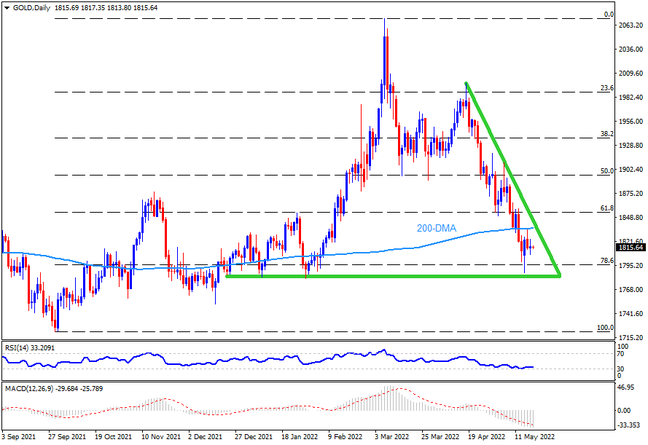

Gold prices hold lower grounds below the 200-DMA so far during the week, backed by downbeat MACD and RSI (14). The recovery moves, if any, also need to cross a downward sloping trend line from April around $1,845, in addition to remaining beyond the 200-DMA level surrounding $1,837, to be appealing to the bulls. Following that, an upward trajectory towards the November 2021 peak surrounding $1,877 and the 50% Fibonacci retracement level of September 2021 to March 2022 upside, close to $1,895, can’t be ruled out.

Meanwhile, the 78.6% Fibonacci retracement level of $1,795 offers immediate support to the quote before the yearly horizontal support zone near $1,782. It’s worth noting that the nearly oversold RSI conditions may restrict the metal’s downside past $1,782, if not then the December 2021 low near $1,751 and September 2021 bottom of $1,721 could lure the bears.

Overall, gold remains on the bear’s table with a limited downside gap on hand.

Join us on FB and Twitter to stay updated on the latest market events.