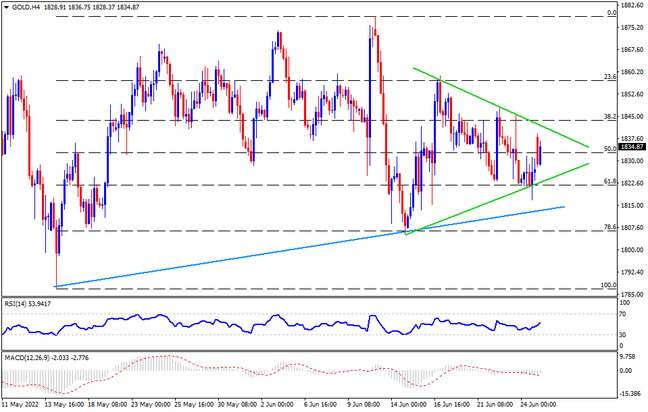

Gold remains inside a two-week-old symmetrical triangle but the bulls seem running out of steam of late. That said, the stated triangle’s bottom line and an upward sloping trend line support from May, respectively around $1,822 and $1,812, could challenge the metal’s short-term downside. Also acting as a downside filter is the 78.6% Fibonacci retracement of the May-June upside, close to $1,805. In a case where the gold prices drop below $1,805, the odds of witnessing a south-run towards the yearly low near $1,786 can’t be ruled out.

On the contrary, the resistance line of the triangle, near $1,840, guards the short-term recovery of the precious metal. Should the bulls manage to cross the $1,840 hurdle, the 23.6% Fibonacci retracement level near $1,858 could test the upside momentum before highlighting the monthly high, around $1,880. It’s worth noting that the late 2021 peak also increases the strength of the $1,880 hurdle.

Overall, gold prices are likely to witness a gradual downside unless crossing the $1,880 key resistance. However, multiple important statistics and central bankers’ speeches could offer a surprise. Hence, gold bear’s discretion is required during the week.

Join us on FB and Twitter to stay updated on the latest market events.