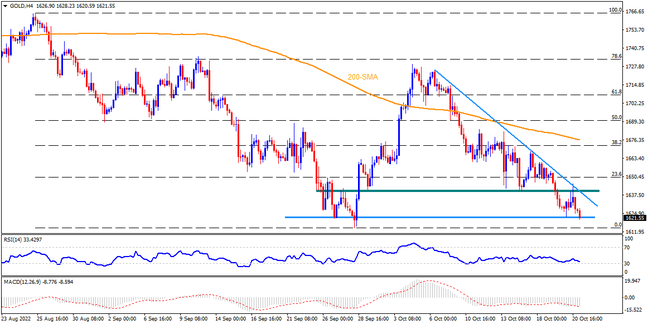

Gold braces for the second weekly loss but the bears appear hesitant around the yearly low. On the top of that, a bullish triangle formation and nearly oversold RSI suggest that the metal may witness a bounce. Hence, a convergence of the monthly horizontal resistance and the three-week-old descending trend line, forming part of the bullish triangle, around $1,643, gain major attention. Should the metal buyers manage to cross the resistance confluence, an upswing to the 200-SMA level of $1,678 becomes imminent on the way to the theoretical target surrounding the monthly high near $1,700.

Alternatively, pullback moves need to defy the triangle formation by breaking the $1,620 support. Even so, the yearly bottom of $1,614-15 could test the bears before directing them to the $1,600 threshold. Following that, April 2020 low and August 2019 top, respectively near $1,572 and $1,557, could entertain the sellers. In a case where the gold price remains weak past $1,557 the year 2020 low of $1,451 will be in focus.

Overall, gold sellers are running out of steam but the buyers need a clear break of $1,643 for even a small rebound.

Join us on FB and Twitter to stay updated on the latest market events.