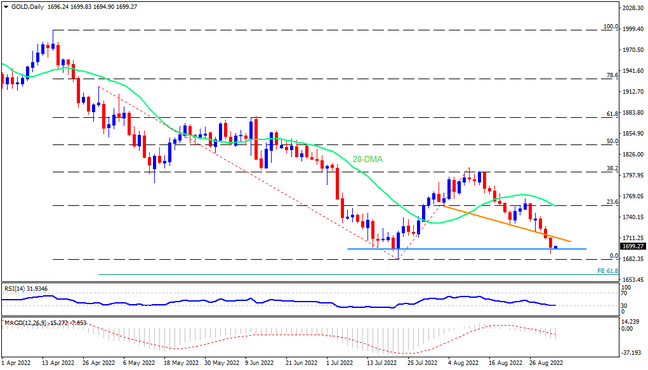

Gold flirts with the $1,700 threshold as it approaches the yearly bottom ahead of the key US Nonfarm Payrolls (NFP) data. The yellow metal’s latest fall justifies bearish MACD signals. However, the RSI nears the oversold territory, which in turn suggests limited downside room. Hence, even if the quote breaks the yearly low of $1,680, the further declines could be smaller. This highlights the 61.8% Fibonacci Extension (FE) level from late April to early August, near $1,660. Even if the quote drops below the $1,660 support, a late March 2020 peak near $1,644 could act as an additional downside filter before dragging the bullion towards the $1,600 threshold.

Alternatively, multiple swings of July portray the $1,700 as an immediate resistance ahead of the monthly downward sloping trend line, previous support near $1,710. Following that, the late August swing low near $1,727 and the 20-DMA surrounding $1,760 could gain the market’s attention. It’s worth noting that a daily closing beyond $1,760 will enable the bulls to aim for the previous monthly peak of $1,808.

Overall, gold bears are likely to keep reins but the downside room is limited, which in turn suggests the brighter scope of recoveries in case the data disappoints.

Join us on FB and Twitter to stay updated on the latest market events.