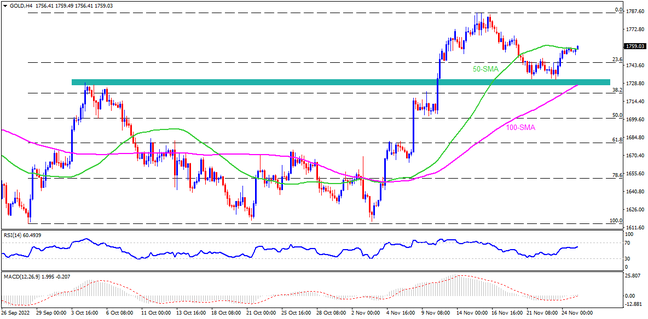

Gold pierces 50-SMA as it braces for the weekly gains with a four-day uptrend. The upside momentum also gains support from the MACD and RSI indicators and portrays a nice bounce off the previous monthly peak. With this, the yellow metal is set for refreshing the monthly peak surrounding $1,787. In that case, the $1,800 threshold gains major attention ahead of August month’s high near $1,808. It’s worth noting that the bullion’s successful run-up beyond $1,808 enables the bulls to retake control and aim for June’s top surrounding $1,880.

Alternatively, failure to stay beyond the 50-SMA level surrounding $1,756 could drag gold prices towards the seven-week-old resistance-turned-support that also encompasses the 100-SMA around $1,730-28. Should the precious metal fail to bounce the key support zone, the 50% Fibonacci retracement level of its September-November upside, near the $1,700 round figure, could act as the last defense for buyers. It should be observed that the quote’s weakness past $1,700 won’t hesitate to recall $1,680 on the chart.

To sum up, gold buyers are all in to refresh the monthly high.

Join us on FB and Twitter to stay updated on the latest market events.