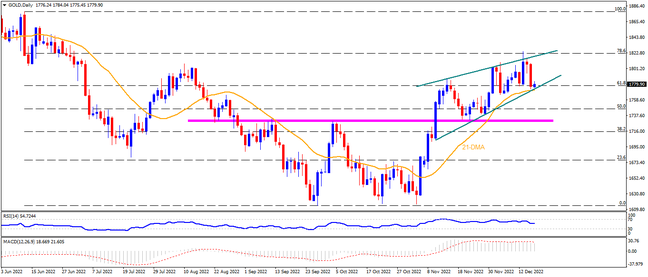

Gold bears struggle inside a one-month-old rising wedge bearish formation, recently bouncing off the support line. The 21-DMA adds strength to the confirmation point near $1,770, which is the lower line of the pattern. A clear break of the same could trigger a slump toward nearly four-month-long horizontal support surrounding $1,730. Following that, the $1,700 threshold and the theoretical target of the rising wedge, close to $1,650, will gain the market’s attention.

Meanwhile, the $1,800 round figure and the upper line of the stated wedge, around $1,818, could lure gold buyers. In a case where the metal crosses the $1,818 resistance, the 78.6% Fibonacci retracement level of the mid-June to late September downside, near $1,821, could challenge the bulls before giving them the throne. In those conditions, $1,858 and $1,880 may act as buffers during the north run that ultimately aims for the $1,900 round figure.

Overall, Gold price loses upside momentum but the sellers have a tough task to retake power.

Join us on FB and Twitter to stay updated on the latest market events.