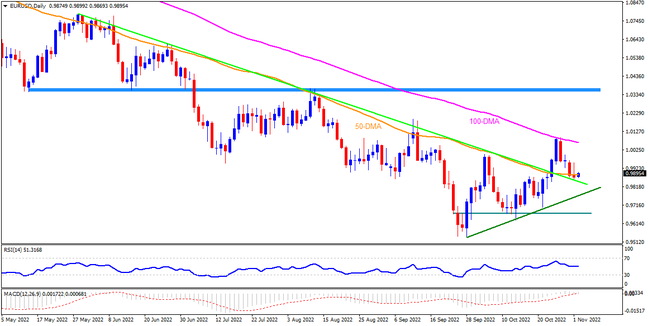

Despite retreating from the 100-DMA during the last week, EURUSD defends the upside break of the 50-DMA and five-month-old descending trend line as traders await the Fed’s verdict on Wednesday. The major currency pair’s latest rebound also gains support from the firmer oscillators. As a result, bulls are hopeful of overcoming the 100-DMA hurdle surrounding 1.0070. Even so, the previous monthly top surrounding 1.0095 and the 1.0100 hurdle could test the upside momentum before giving control to buyers. In that case, a run-up towards the horizontal resistance area comprising multiple levels marked since May 12, close to 1.0360, appears more likely to follow.

Meanwhile, a downside break of the resistance-turned-support and the 50-DMA, surrounding 0.9880, could quickly drag EURUSD towards a five-week-long support line near 0.9780. Should the quote break the nearby trend line support, the 0.9670-60 support region will gain the bear’s attention before targeting the yearly low near 0.9535.

Overall, EURUSD is up for reversing the downward trajectory established in June. However, it all depends upon how well the Federal Reserve policymakers can convince markets of their dovish hike.

Join us on FB and Twitter to stay updated on the latest market events.