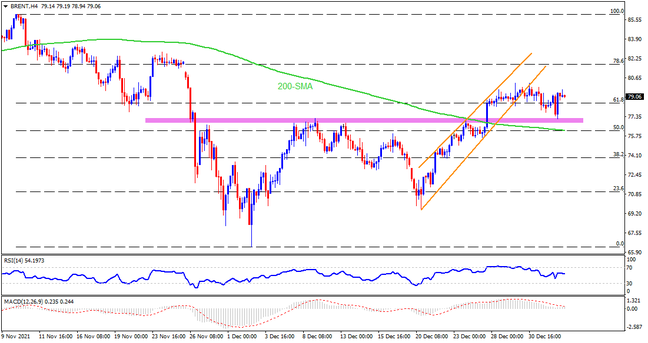

Brent oil sees further downside after confirming short-term rising wedge bearish chart pattern the last week. However, oil traders turn cautious ahead of today’s OPEC+ JTC meeting and monthly print of the US ISM Manufacturing PMI. That said, a five-week-old horizontal area and 200-SMA, respectively around $77.20-76.80 and $76.25, restrict the immediate downside of the commodity ahead of today’s key events. In a case where the UK oil benchmark drops below $76.25, the mid-December swing low of $72.85 will be in focus.

Alternatively, recovery moves remain elusive below the recent tops surrounding the $80.00 psychological magnet. Following that, oil buyers can quickly rush towards the late November’s top surrounding $82.80-85 and then to the November 10 peak of $86.00 should return to the chart. However, a clear run-up beyond the $82.85 won’t hesitate to cross the 2021 high surrounding $86.70. To sum up, Brent oil sellers have firmer grips on the prices ahead of the key events that might turn out as a challenge for bears.

Join us on FB and Twitter to stay updated on the latest market events.