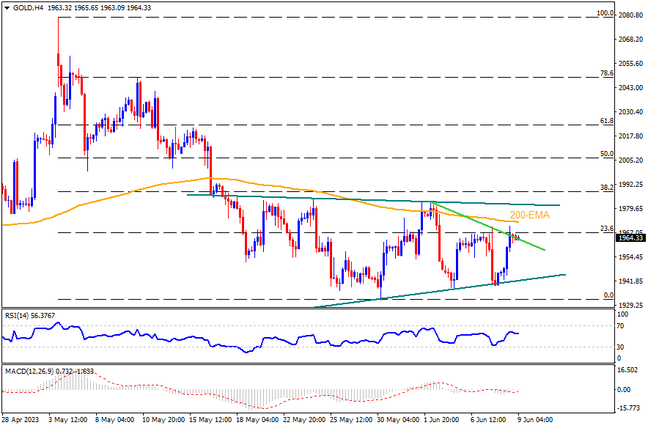

Despite bracing for the second consecutive weekly gain, the Gold buyers appear running out of steam as the metal stays within a three-week-old bearish triangle, recently bouncing off the chart pattern’s bottom line. The latest recovery may initially gain momentum on breaking the weekly resistance line, around $1,965 by the press time, which in turn can challenge the 200-EMA surrounding $1,973. However, the XAUUSD buyers remain off the table unless witnessing a clear upside break of the stated triangle’s top line, close to $1,982 by the press time.

Meanwhile, Gold sellers can retake control on witnessing a clear downside break of the stated triangle’s bottom line, around $1,942 at the latest. Following that, the yearly low of near $1,932 may act as an extra check towards the south before dragging the quote towards the theoretical target of the triangle break, which is $1,888. However, multiple supports near $1,910 and the $1,900 threshold could challenge the bullion bears on their ruling.

Overall, Gold portrays bearish consolidation by the end of the unimpressive week. Though the next one is all-important as it comprises monetary policy meetings of the Fed and ECB.

Join us on FB and Telegram to stay updated on the latest market events.