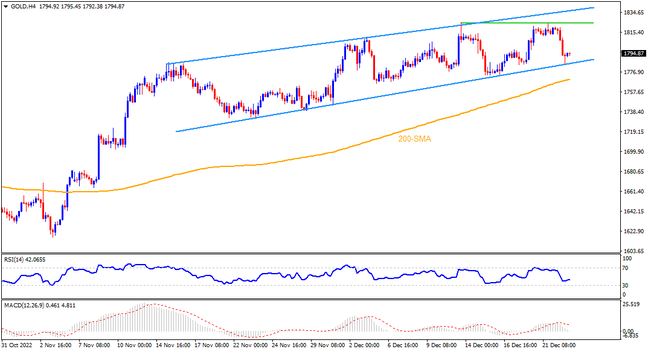

Gold retreats from a weekly horizontal resistance that’s near a top-end of an upward-sloping trend channel stretched since mid-November. Not only the stated channel’s upper line but RSI pullback and looming bear cross on the MACD also suggest that the gold buyers are running out of steam. As a result, a pullback towards the stated bullish channel’s support, near $1,785, appears imminent. However, a lack of market participation due to the year-end holidays may restrict the metal’s moves around then, if not then the 200-SMA near $1,767 could challenge the bears.

Alternatively, the aforementioned horizontal hurdle near $1,823-25 limits the precious metal’s immediate upside before highlighting the five-week-old rising channel’s top line, close to $1,837. In a case where gold buyers manage to cross the $1,837 resistance, June’s high near $1,880 could act as a tough nut to crack for the bulls targeting the $1,900 threshold.

Overall, gold buyers appear to run out of steam but the downside also seems bumpy and the holiday season could play its role too. Hence, the metal may grind higher as traders prepare for the one last shot of important US data.

Join us on FB and Twitter to stay updated on the latest market events.