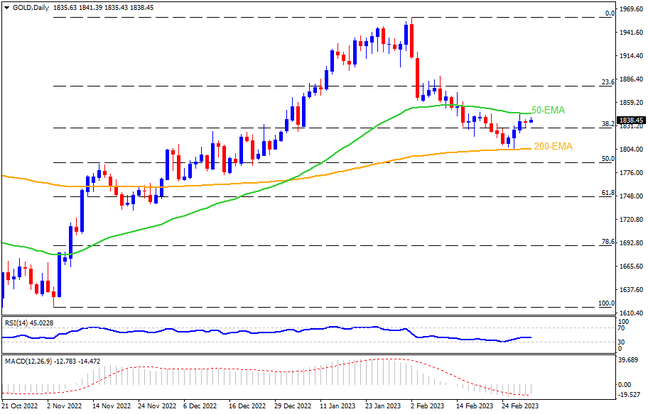

Gold braces for the first weekly gain in five but stays within the key moving average envelope as traders eye Fed Chair Jerome Powell’s testimony and the US NFP data, up for release in the next week. It’s worth noting, however, that the bears appear to run out of steam, per the RSI and MACD conditions. As a result, a clear upside break of the 50-Exponential Moving Average (EMA), around $1,845 by the press time, could convince the buyers to retake control. Though, multiple hurdles around $1,865 and $1,890 might challenge the XAUUSD run-up before the metal can regain $1,900.

Meanwhile, a surprise downturn remains unimpressive beyond the 200-EMA level surrounding $1,803. Also acting as an extra filter to the south is the $1,800 threshold. In a case where the Gold price remains bearish past $1,800, the 61.8% Fibonacci retracement level of the quote’s run-up from last November to February 2023, around $1,747, will gain the market’s attention. It should be noted that the late November low of $1,727 may act as the last resort for the buyers before totally giving up control during the metal’s weakness past $1,747.

Overall, the Gold price remains sidelined but the downside momentum gains less acceptance ahead of an important week.

Join us on FB and Telegram to stay updated on the latest market events.