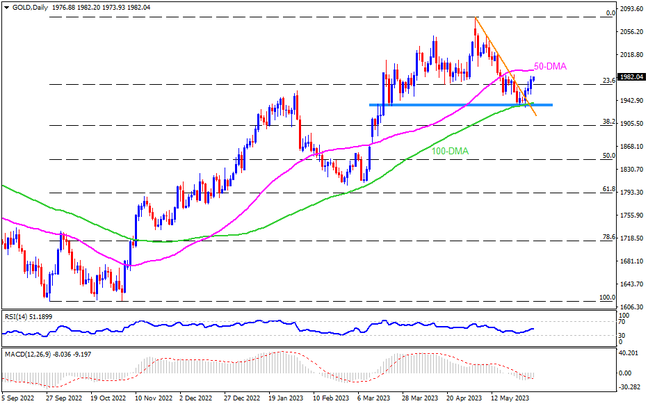

Gold price extends rebound from an 11-week-old horizontal support zone, as well as the 100-DMA, as it approaches the 50-DMA hurdle surrounding $1,992. Adding strength to the bullish bias is the metal’s upside break of a one-month-old descending resistance line, now support staying within the aforementioned horizontal region surrounding $1,932-40. Furthermore, the looming bull cross on the MACD and gradually rising RSI (14) line also keep the XAUUSD buyers hopeful to extend the run-up towards the immediate DMA hurdle. It’s worth observing that the $2,000 round figure acts as an extra filter towards the north. However, a clear upside break of the same could quickly propel the metal toward the $2,050 resistance area before challenging the all-time high of nearly $2,080.

On the contrary, the Gold price downside needs validation from the previously stated support zone near $1,940-32, including the 100-DMA, the previous resistance line stretched from early May and multiple levels marked since mid-March. Following that, the 38.2% Fibonacci retracement of the September 2022 to May 2023 upside, near $1,896, could be the next stop for the metal sellers. In a case where the XAUUSD remains bearish past $1,896, the 5% Fibonacci retracement and the yearly low marked in February, respectively near $1,845 and $1,804, quickly followed by the $1,800 round figure, will be in the spotlight.

Overall, Gold price is likely to recover but the road towards the north isn’t smooth and hinges on the US Nonfarm Payrolls (NFP) data.

Join us on FB and Telegram to stay updated on the latest market events.