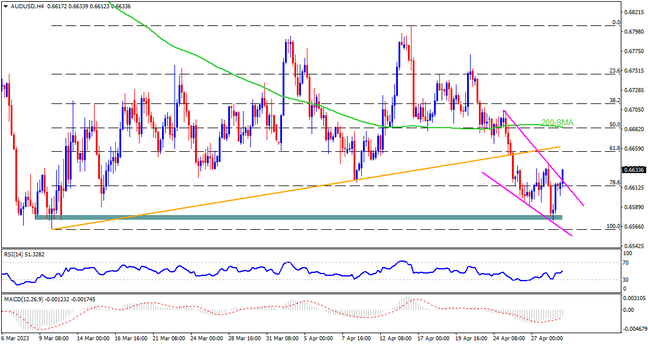

AUDUSD marked negative closings in the last two consecutive weeks ahead of the Reserve Bank of Australia’s (RBA) monetary policy decision. That said, the previous weekly fall could be linked to a downside break of a seven-week-old ascending support line. However, the Aussie pair recently confirmed a short-term falling wedge bullish chart formation. The same joins the gradually ascending RSI line to suggest further consolidation of the latest losses. However, the quote needs to stay beyond the 0.6630 hurdle. Even so, an upward-sloping support-turned-resistance line from early March and 61.8% Fibonacci retracement of the pair’s March-April upside, close to 0.6660, can challenge the pair buyers. Following that, the 200-SMA level of 0.6685 acts as the last defense of the bears.

On the contrary, a seven-week-old horizontal support zone near 0.6575-70 appears a tough nut to crack for the AUDUSD bears to retake control. In that case, the yearly low marked in March around 0.6560 may act as an extra challenge for the sellers before retaking the driver’s seat. Following that, the Aussie pair will be all set for the previous yearly low surrounding 0.6165. Though, the round figures may offer intermediate halts during the anticipated downturn.

Overall, AUDUSD bears are likely to take a breather but won’t leave the table unless RBA offers a positive surprise and Fed disappoints, both of which are hardly expected.

Join us on FB and Telegram to stay updated on the latest market events.